You just received the three proposals for content syndication services. Vendor A charges $75 per lead. Vendor B charges $40 CPM. Vendor C wants $15,000 monthly on a flat-fee retainer.

We know each CPL (cost per lead), CPM (cost per thousand impressions), and flat fee in theory. But how do you compare the actual value?

There is no apple-to-apple comparison. You are actually comparing apples to oranges – comparing things that are fundamentally different.

B2B content syndication is complex, and the vendors aren’t always transparent. Hidden costs and wrong model selection can waste thousands of dollars.

Worried about making a wrong call or being blamed for poor ROI? This blog will guide you to create a clear, unbiased framework for making the right choice.

Table of Contents

- 1 Why Pricing Transparency Matters: The Math That Changes Everything

- 2 The 5 Main Content Syndication Pricing Models

- 3 Key Takeaway: Focus on Value, Not Just Price

- 4 Why At Only B2B, We Prefer Transparent & Intent-Driven Pricing

Why Pricing Transparency Matters: The Math That Changes Everything

Let’s learn from the real-world scenario of why understanding the pricing is essential to defining your bottom line.

Scenario: You have a $30,000 quarterly budget for content syndication. Your goal is to generate SQLs (Sales Qualified Leads) that convert to customers at a 15% close rate, with an average deal size of $25,000.

Simple Content Syndication ROI Calculator (Template/Table)

| Input Variable | Option A (High-Quality CPL) | Option B (Low-Cost CPL) | Option C (Custom/Flat Fee/Other) |

|---|---|---|---|

| Quarterly Budget ($) | 30,000 | 30,000 | |

| Pricing Model | $75/lead | $30/lead | (e.g., $15,000/mo flat fee) |

| Expected # of Leads | =Budget ÷ CPL = 400 | =Budget ÷ CPL = 1,000 | (Insert estimate or vendor data) |

| % That Become SQLs | 20% | 5% | |

| # SQLs | =Leads × SQL % = 80 | =Leads × SQL % = 50 | |

| Sales Close Rate (%) | 15% | 15% | |

| Customers Closed | =SQLs × Close Rate = 12 | =SQLs × Close Rate = 7.5 | |

| Average Deal Size ($) | 25,000 | 25,000 | |

| Total Revenue ($) | =Customers × Deal Size = $300,000 | =Customers × Deal Size = $187,500 |

It turns out the “expensive” $75 CPL vendor just generated $112,500 more revenue from the same budget because of superior lead quality.

So yes, lower CPL is not always better. That is why understanding the pricing model is paramount. This blog breaks down 5 main content syndication pricing models to help you make the best choice to hit your ROI goals.

The 5 Main Content Syndication Pricing Models

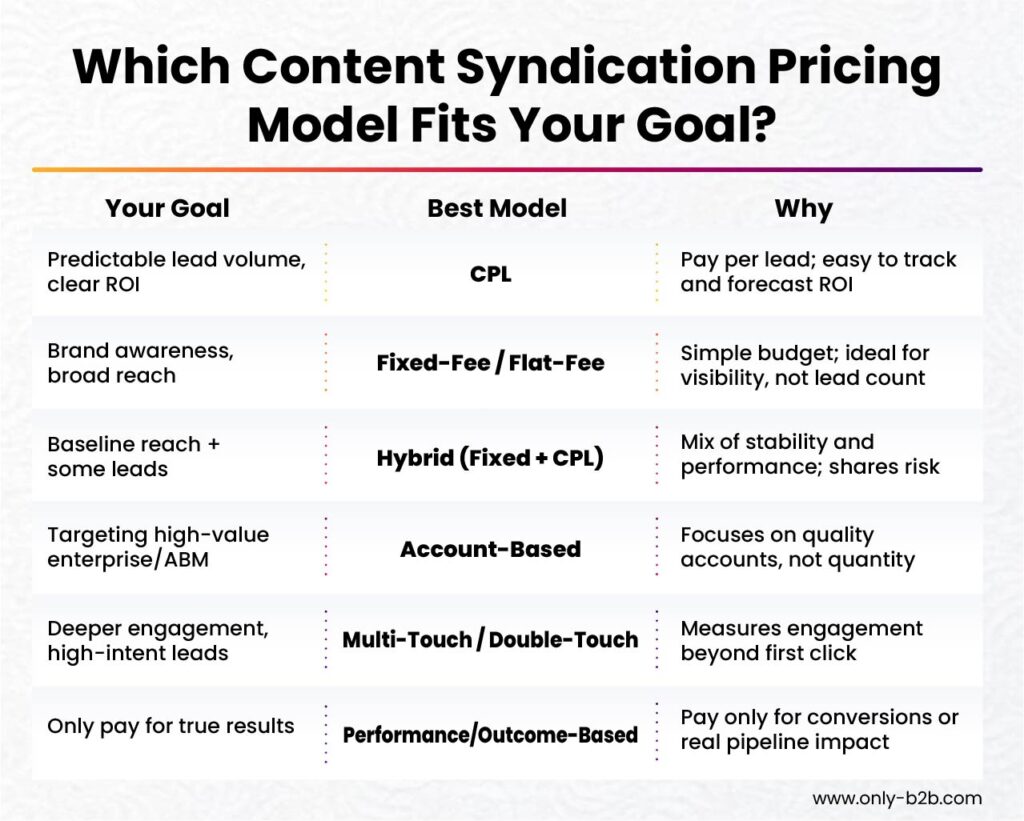

Content syndication pricing models differ based on what you’re actually purchasing – leads, impressions, access, outcomes, or a combination.

The five main models are:

- Cost Per Lead (CPL): You pay for each qualified lead delivered

- Cost Per Thousand Impressions (CPM): You pay for content views or downloads

- Flat Fee/Retainer Model: You pay a fixed monthly amount for services

- Performance-Based Pricing: You pay based on specific outcomes like MQLs or opportunities

- Hybrid Models: You combine elements of the above

Each model shifts risk and reward differently between you and the vendor. Let’s explore how.

Cost Per Lead (CPL) Model

How It Works

With the conventional CPL pricing model, you pay a fixed amount for each lead that meets the stipulated qualification criteria. The vendor distributes your content across multiple channels. You are only charged when someone engages and submits their information, provided that they satisfy criteria like job title, company size, and stated interest.

It’s a “pay per result” model. Essentially, you are not paying for distribution; you’re paying for actual people who expressed interest in your content.

Typical Price Ranges

CPL pricing varies dramatically based on lead quality:

- Basic leads with minimal qualification: $25–$50 per lead

- Marketing Qualified Leads with verification: $50–$120 per lead

- Sales Qualified Leads with intent signals: $100–$250+ per lead

- Enterprise/niche targeting: $200–$400+ per lead

Of course, the pricing spread exists because not all leads are the same. The value of someone randomly downloading a form is fundamentally different from an ICP researching your solutions.

When CPL Makes Sense

Qualified leads, as per the vendor, didn’t meet your ICP. This happens when qualification criteria are not clearly articulated.

Here, you must have an established lead scoring process to make the most of the leads you receive. This model is ideal if you require budget predictability and have strong analytics in place, so the actual cost per customer isn’t visible until much later.

However, quality varies vendor to vendor, even when they meet your stated criteria. The price per lead doesn’t automatically equal your cost per customer, and conversion rates vary significantly. CPL is particularly well-suited for modest volume needs, typically 100–500 leads per month.

Cost Per Thousand Impressions (CPM) Model

How It Works

CPM pricing charges you for every 1,000 times your content is displayed to potential readers, regardless of whether they engage. You’re essentially paying for exposure rather than results, similar to traditional advertising.

However, many marketers are wary of the CPM model because it puts performance risk on you. The vendor gets your content in front of the right audience; what happens next depends solely on your content quality and offer.

Typical Price Ranges

The cost depends heavily on audience specificity:

- Standard B2B audiences: $15–$35 CPM

- Targeted professional audiences: $35–$60 CPM

- Highly specialized or executive audiences: $60–$100+ CPM

Getting your content in front of 1,000 mid-level marketing managers is easier and cheaper than reaching 1,000 CFOs at Fortune 500 companies.

When CPM Makes Sense

CPM delivers maximum reach, making it excellent for brand awareness and top-of-funnel visibility. This model is good for testing content resonance before committing to more expensive lead-generation models.

The downside is no guarantee of engagement. You pay even if no one converts. Also, ROI tracking is difficult because it’s hard to connect impressions to revenue.

If you want broad awareness for a new product or have content designed for top-of-funnel engagement, this model is a sure shot.

Let’s do the math: at $40 CPM with a $20,000 budget, you get 500,000 impressions. With a 2% engagement rate, that’s 10,000 downloads. If 5% submit forms, you’ve generated 500 leads at an effective CPL of $40. The economics work, provided your content converts at healthy rates.

Flat Fee/Retainer Model

How It Works

You pay a fixed monthly or quarterly fee for a defined scope of syndication services. This typically includes content distribution, a minimum number of leads or impressions, detailed reporting, and strategic support like content optimization recommendations.

The flat fee model transforms your vendor from a lead supplier into a strategic partner. Essentially, they are paid to deliver quality results because revenue depends on renewal, not volume targets.

Typical Price Ranges

Pricing scales with program complexity:

- Small programs (startups/SMBs): $5,000–$15,000/month

- Mid-market programs: $15,000–$40,000/month

- Enterprise programs: $40,000–$100,000+/month

These ranges reflect not just lead volume but also the level of service, strategic input, and partnership you’re receiving.

When Flat Fee Makes Sense

The flat fee model offers complete budget predictability. You get a strategic partnership where vendors are incentivized for retention rather than hitting quotas. There’s flexibility to adjust tactics within the retainer as you learn what works.

However, high upfront commitment is a big challenge since you pay regardless of immediate results. And it’s hard to compare against CPL vendors in an apples-to-apples way. Scaling can be challenging since the fixed fee doesn’t automatically increase with success.

Flat fee works best when you have predictable, ongoing lead generation needs and want a strategic partner who’ll help you improve over time.

Consider a $25,000 monthly retainer delivering 250 qualified leads – that’s an effective CPL of $100, but includes account management, optimization, A/B testing, and reporting that can improve quality by 30% over six months.

Performance-Based & Hybrid Models

How They Work

Performance-based pricing means you pay based on specific business outcomes – MQLs that enter your pipeline above a certain score, opportunities created, or even closed revenue. The vendor shares both risk and reward.

Hybrid models combine elements of multiple structures:

- Base retainer + CPL for leads exceeding minimums

- CPL pricing with quality bonuses for high SQL conversion

- Flat fee + performance bonuses tied to pipeline contribution

A performance deal might look like $150 per MQL scoring above 75 in your MAP, $500 per opportunity created, or 5–10% of closed-won revenue from syndication.

When These Models Make Sense

These models create aligned incentives where vendors succeed only when you succeed. Risk is shared, and conversations shift from volume metrics to business value.

However, tight CRM integration and sophisticated attribution tracking are a must. You’ll pay higher per-unit costs because vendors price at risk. So, expect longer commitments since vendors need time to optimize your outcomes.

Performance and hybrid models work best when you have sophisticated marketing operations with clean data flows, can track leads through your entire funnel, and want a true partnership with aligned incentives rather than transactional relationships.

Key Takeaway: Focus on Value, Not Just Price

The “best” pricing model isn’t the cheapest. It’s the one delivering the highest quality outcomes at a sustainable customer acquisition cost. Remember: the $75 CPL vendor generated $112,500 more revenue than the $30 vendor from the same budget because of superior lead quality.

Calculate your acceptable CAC, start with pilot programs testing 2–3 vendors, and track ruthlessly by measuring lead-to-customer conversion rates. A $200 lead that closes at 20% is infinitely more valuable than a $30 lead that never converts.

Why At Only B2B, We Prefer Transparent & Intent-Driven Pricing

At Only B2B, we believe in clear, predictable, and data-driven syndication. That means:

- Clear definitions of what counts as a “qualified lead.”

- Human-verified firmographic data and ICP match

- Transparent reporting and full visibility into targeting criteria, performance metrics, and conversion paths

- Focus on intent data and targeted syndication over mass distribution, prioritizing delivering value, not volume

This approach reduces risk, improves lead quality, and ensures that our clients pay for what matters: pipeline impact, not just traffic or downloads.

Vikas Bhatt is the Co-Founder of ONLY B2B, a premium B2B lead generation company that specializes in helping businesses achieve their growth objectives through targeted marketing & sales campaigns. With 10+ years of experience in the industry, Vikas has a deep understanding of the challenges faced by businesses today and has developed a unique approach to lead generation that has helped clients across a range of industries around the globe. As a thought leader in the B2B marketing community, ONLY B2B specializes in demand generation, content syndication, database services and more.