B2B SaaS growth used to be a volume game. More leads at the top of the funnel were assumed to translate into more revenue at the bottom.

That logic made sense when buying decisions were simpler, sales cycles were shorter, and a small number of stakeholders controlled spend.

That environment no longer exists.

Today, SaaS buying is defined by multi‑stakeholder buying cycles, extended evaluations, heightened risk scrutiny, and recurring revenue models that amplify the cost of poor fit customers over time.

Growth teams are not falling short because they lack activity, tools, or ambition. They are struggling because lead based marketing was never designed to support this level of structural complexity.

Account based marketing benefits businesses in such scenario. Instead of optimizing for lead volume, it optimizes for account relevance. Instead of assuming a linear funnel, it reflects how buying groups actually move i.e. forward, sideways, and sometimes backward, before a decision is made.

We have observed ABM use cases for B2B SaaS consistently demonstrate 3–5x higher ROI than traditional demand generation approaches.

What changes with ABM is not the effort applied, but the logic behind it. Attention becomes intentional. Resources are allocated based on long-term value rather than short-term conversion signals. Growth shifts from accumulation to alignment.

Not because ABM creates more noise. But because it removes misalignment.

For SaaS companies operating in competitive, saturated categories, ABM is not a trend or an experiment. It is a response to how modern software is evaluated, purchased, expanded, and renewed across increasingly complex organizations.

Why ABM Is Critical for SaaS in 2026

Table of Contents

- 1 Why ABM Is Critical for SaaS in 2026

- 2 How ABM Helps?

- 3 Use Case 1: Precision Targeting to Increase Win Rates

- 4 Use Case 2: Sales and Marketing Alignment

- 5 Use Case 3: Personalization at Scale

- 6 Use Case 4: Resource Efficiency

- 7 Use Case 5: Predictable Pipeline

- 8 ABM Channels & Playbook

- 9 Measuring Success

- 10 Conclusion

B2B SaaS companies operate under a specific set of constraints that generic marketing frameworks fail to address. These SaaS ABM challenges are structural, not tactical, and they compound as organizations scale.

Understanding them clarifies why ABM use cases for B2B SaaS are becoming foundational rather than experimental.

Buying decisions are owned by buying groups, not individuals

Modern SaaS purchases are evaluated by cross functional buying groups that include security, IT, finance, procurement, and business leadership.

Each stakeholder applies a different risk framework, timeline, and success criterion. Progress is rarely linear.

Deals stall not because interest disappears, but because internal consensus is unresolved. Traditional funnels obscure this reality, making it difficult to diagnose where and why momentum breaks down.

Revenue models amplify the cost of poor fit

Subscription economics turn early acquisition mistakes into long-term drag. Poor fit customers consume disproportionate support resources, resist expansion, and quietly depress net revenue retention.

These downstream effects are rarely attributed back to acquisition strategy, which is one of the most persistent SaaS ABM challenges when teams rely on volume driven demand generation.

Lead centric metrics fail to reflect account readiness

Individual engagement signals do not indicate whether an organization is ready to buy. High MQL volume can coexist with weak pipeline health.

Activity metrics offer no insight into whether buying groups are aligned, internally conflicted, or even aware of the problem being marketed. This disconnect creates false confidence and unpredictable forecasting.

How ABM Helps?

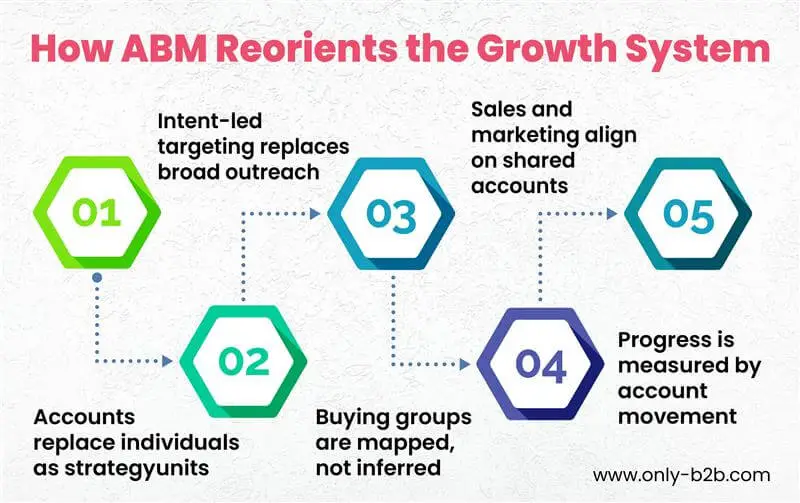

ABM solves these SaaS specific challenges by shifting the unit of focus.

- Accounts, not individuals, become the center of strategy.

- Intent led targeting replaces broad outreach. ‑

- Buying groups are mapped instead of inferred.

- Sales and marketing align around shared account lists rather than competing KPIs.

By 2026, this shift is no longer optional. Privacy constraints limit third-party data. Buyers are fatigued by generic messaging. Growth efficiency matters more than raw scale.

SaaS companies that fail to adopt ABM will not necessarily stop growing but they will grow with less confidence, visibility, and predictability.

ABM does not accelerate growth by pushing harder. It accelerates growth by reducing friction across the system.

Use Case 1: Precision Targeting to Increase Win Rates

One of the most documented ABM use cases for B2B SaaS is win rate improvement through precision targeting.

When teams narrow focus to a defined set of high fit accounts, sales conversations change qualitatively.

Engagement begins later in the buying journey, with organizations that already resemble existing customers in structure, urgency, and complexity. Discovery becomes validation rather than education.

Define a revenue backed ideal customer profile (ICP)

Precision targeting begins with a rigorously defined ICP rooted in historical revenue performance, not assumptions. Industry, company size, regulatory environment, internal maturity, technology stack, security posture, and expansion potential are evaluated together to identify accounts that consistently deliver long-term value.

Identify and prioritize accounts against that ICP

Once defined, the ICP becomes a filter. Target accounts are selected based on closeness of fit rather than surface level demand signals. This reduces early stage noise and ensures that pipeline creation reflects strategic intent instead of opportunistic reach.

Apply tiered account engagement

Accounts are segmented into tiers based on value and complexity. Tier one accounts receive coordinated, high touch engagement across sales and marketing.

Tier two and tier three accounts follow the same logic with scaled execution. This structure preserves focus while preventing internal teams from overextending.

Validate fit through buying group signals

As engagement unfolds, teams assess real buying group participation. Signal quality, stakeholder diversity, and progression pace are used to confirm or challenge initial assumptions.

Accounts that fail to demonstrate alignment are pushed back early, protecting sales capacity and pipeline integrity.

Reinforce discipline with measurable outcomes

The impact of this approach is consistently visible. The results are measurable. As per ITSMA research ITSMA research 87% of B2B marketers agree that account based marketing strategies deliver higher ROI than any other marketing approach.

The improvement did not come from better sales scripts or more persuasive messaging.

It came from selecting the right accounts in the first place. In ABM, win rates are not optimized at the close. They are engineered at the top.

Use Case 2: Sales and Marketing Alignment

Sales and marketing misalignment is often treated as a cultural issue.

In reality, it is structural.

When marketing is measured on lead volume and sales is measured on revenue, friction is inevitable. Hand offs feel arbitrary. Attribution becomes contentious. Pipeline velocity slows as teams operate from different definitions of progress and success.

ABM resolves this by establishing the account as the shared unit of value.

Instead of reporting on leads generated, teams track account movement. Instead of debating lead quality, they assess buying group engagement.

This shared focus reduces ambiguity and eliminates many of the silent inefficiencies that slow growth.

Mature ABM programs consistently report friction reductions and give 60% higher win rates compared to disjointed efforts. Meetings become shorter. Forecasts become clearer. Decisions rely less on interpretation and more on observable account behavior.

Alignment also improves pipeline velocity. Messaging remains consistent across touch points. Outreach is sequenced rather than duplicated. Sales feedback informs marketing adjustments in near real time, closing the loop between signal and action.

The result is not just operational efficiency.

It is coordinated momentum across the revenue engine.

Use Case 3: Personalization at Scale

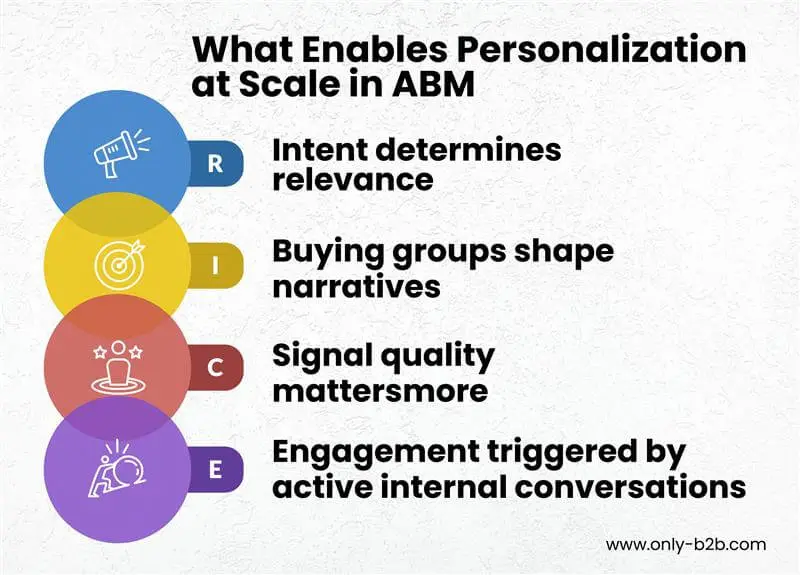

Personalization is often misinterpreted as customization.

In ABM, personalization at scale is about relevance delivered systematically.

Intent data enables this approach. By understanding which topics accounts are actively researching, SaaS teams can tailor messaging without guesswork.

Automation ensures these insights trigger timely emails, targeted ads, outbound sequences, and adaptive website experiences.

This allows messaging to reflect buying group realities rather than generic personas. Security leaders encounter narratives around risk and compliance.

Finance stakeholders see cost control and ROI framing. Operators see implementation clarity, timelines, and integration pathways.

What changes is not just content, but timing and sequencing. Accounts are engaged when internal conversations are already active, not when campaigns happen to be scheduled. This reduces the cognitive load on buyers and increases the perceived relevance of every interaction.

The performance impact is significant. SaaS companies running intent driven ABM campaigns regularly report email open rates above 50%, with some reaching 56% or higher. More importantly, engagement reflects real buying interest rather than passive curiosity or accidental clicks.

At scale, personalization does not increase workload.

It increases signal quality.

It also increases trust, because buyers recognize when messaging mirrors their internal priorities rather than marketing calendars.

Use Case 4: Resource Efficiency

ABM fundamentally changes how resources are deployed.

By concentrating effort on high fit accounts, SaaS companies reduce spend on low probability opportunities. Customer acquisition costs decline not because budgets are cut, but because effort compounds instead of dispersing across unqualified demand.

At the same time, average contract values tend to increase. Conversations expand earlier in the sales cycle. More stakeholders engage sooner. Deal scope grows organically as trust builds across the accoun

Use Case 5: Predictable Pipeline

As account progression is tracked holistically, pipeline forecasting becomes more accurate. Leaders can identify which accounts are warming, which are stalled, and which are primed for expansion. Planning improves. Revenue volatility decreases.

Post sale, ABM supports upsell and cross sell by maintaining account level engagement beyond the initial contract. Many SaaS organizations report measurable improvements in net revenue retention as a result of this continuity and relevance.

Resource efficiency creates leverage. Predictability creates confidence.

ABM Channels & Playbook

ABM execution in 2026 requires disciplined channel selection rather than channel abundance.

LinkedIn & Programmatic Advertising

LinkedIn and programmatic advertising remain foundational for account level awareness when paired with firmographic filters and intent signals.

Their role is reinforcement, ensuring the right accounts encounter consistent narratives across touchpoints, not flooding the market with impressions.

Content Syndication Platforms

Intent driven content syndication has evolved from volume capture to precision distribution. Instead of maximizing downloads, high performing teams use it to introduce perspective at the exact moment buying groups are educating themselves.

When combined with outbound motions and conversational AI, this approach supports timely, contextual engagement without overwhelming prospects or fragmenting attention across disconnected channels.

Web Personalization

Web personalization and interactive content adapt experiences based on account context, turning the website into an active participant in the buying journey rather than a static destination.

Messaging, proof points, and calls to explore shift based on industry, maturity, and intent signals.

Partner ABM is gaining momentum as SaaS ecosystems mature. Co-targeting strategic accounts with trusted partners expands reach while sharing credibility, insight, and execution effort.

For complex SaaS categories, this often accelerates internal consensus.

Behind these channels sits a consistent playbook.

- Define the ideal customer profile using revenue data.

- Tier accounts by value and complexity.

- Map buying groups realistically rather than aspirationally.

- Align messaging to account stages instead of funnel stages.

- Select channels for reinforcement rather than duplication.

- Build workflows that connect insight to execution across teams.

An ABM playbook is not a campaign plan.

It is an operating system for growth that brings structure to complexity and coherence to execution.

Measuring Success

ABM success cannot be evaluated through surface level metrics.

Traditional volume-based metrics were apparent in lead-centric models, but they fail to explain whether target accounts are genuinely progressing toward revenue. Effective ABM measurement focuses on account movement, buying group alignment, and downstream impact.

Account Engagement

Account engagement signals whether target accounts are moving collectively, not just interacting individually.

Account coverage across stakeholders

Success is reflected in engagement from multiple roles within the same account, indicating buying group formation rather than isolated interest.

Buying group engagement depth

High-quality engagement appears when technical, financial, and business stakeholders interact around related themes, suggesting internal alignment.

High-intent activity

Visits to BOFU pages, demo requests, pricing reviews, security documentation, and implementation content indicate evaluation behavior, not awareness.

Repeat engagement from target accounts

Sustained interaction over time matters more than one-time spikes, signaling ongoing internal discussion and momentum.

Pipeline Impact

ABM performance becomes visible when pipeline quality improves, not just volume.

Pipeline created from target accounts

A growing share of pipeline should originate from pre-defined ABM accounts rather than opportunistic leads.

Pipeline velocity

Opportunities move more consistently when buying groups are engaged early, reducing internal stalls and rework.

Win rate (ABM vs non-ABM)

ABM-sourced opportunities typically close at higher rates due to stronger account fit and clearer buying alignment.

Deal size uplift

Account-centric engagement often results in larger initial contract values and broader deal scope.

Stage conversion rates

Healthier ABM pipelines show fewer drop-offs between qualification, evaluation, and close stages.

Revenue & Expansion

The full value of ABM compounds after the deal closes.

Net Revenue Retention (NRR)

Better-fit accounts expand more reliably and retain longer.

Expansion and up sell revenue

Early buying group alignment creates natural paths for cross-sell and up sell motions.

Churn reduction

Accounts selected through ABM churn less because expectations, use cases, and value alignment are clearer from the start.

CAC-to-LTV improvement

Concentrated effort on high-value accounts improves long-term unit economics.

What Not to Measure in ABM

Some metrics offer surface-level visibility but limited strategic value when used alone:

- MQL volume without account context

- Click-through rates disconnected from buying stages

- One-off engagement spikes from non-target accounts

These may indicate activity, but they do not reflect account readiness or revenue potential.

ABM success ultimately shows up as predictability. When the right accounts engage in the right sequence, pipeline becomes easier to forecast, expansion becomes more reliable, and SaaS growth feels controlled rather than forced.

Conclusion

ABM use cases for B2B SaaS are not about doing more. They are about doing less with greater precision, clarity, and alignment. In a market defined by complexity, clarity becomes the advantage.

Whether you are introducing ABM for the first time or refining an existing program, the objective is the same. Build a system that prioritizes relevance over reach, coordination over volume, and long-term value over short-term activity.

ABM is not a campaign strategy. It is a decision to operate with focus.

For B2B SaaS companies navigating complexity, that focus is no longer optional. It is the difference between growth that feels forced and growth that feels controlled.

Vikas Bhatt is the Co-Founder of ONLY B2B, a premium B2B lead generation company that specializes in helping businesses achieve their growth objectives through targeted marketing & sales campaigns. With 10+ years of experience in the industry, Vikas has a deep understanding of the challenges faced by businesses today and has developed a unique approach to lead generation that has helped clients across a range of industries around the globe. As a thought leader in the B2B marketing community, ONLY B2B specializes in demand generation, content syndication, database services and more.