For a long time, B2B has been tied to numbers. More leads meant more growth. It did work once, but today this is a flawed way to measure growth.

You can’t afford to chase feel-good metrics, especially when sales cycles are longer and multiple stakeholders are involved.

The right conversion metrics reveal where your funnel leaks, how fast money actually moves, and whether retention and expansion can carry growth when net-new slows.

Sure, tools help, but not when the process is weak. Clarity on which metrics matter comes first, followed by systems that keep every team accountable.

And this is exactly what we are looking to unveil in this blog. We will explore the key metrics that directly impact revenue and show you how to track them effectively.

Table of Contents

What Are Conversion Metrics and Why They Matter

Conversion metrics are the measurable metric checkpoints that show whether prospects are moving closer, staying, or turning into customers.

In B2B, this could mean:

- An anonymous visitor turning into a lead

- A marketing-qualified lead being accepted by sales

- An opportunity progressing to a closed-won deal

- Or even beyond, renewals, upsells, and expansions

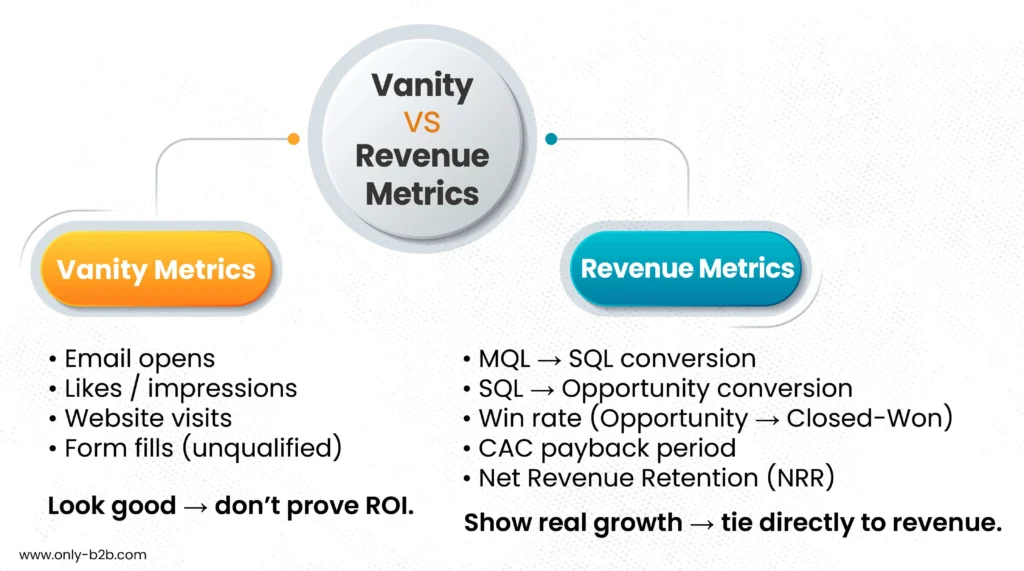

Too often, teams confuse conversions with surface-level actions like clicks, form fills, or downloads. But those glittering numbers can be a trap. They look good on dashboards but rarely impact the bottom line.

When defined correctly, conversion metrics give marketing, sales, and customer success a common narrative. They expose funnel leaks, prove ROI, and tie every effort back to outcomes that truly matter: revenue, retention, and growth.

Funnel Conversion Metrics You Should Be Tracking

Lead → Customer Conversion Rate

Leads may be climbing fast, but if revenue is not, there is a gap between attention and outcomes. “More leads” does not mean more growth. In fact, it magnifies waste if handoffs, qualification, or sales follow-through are broken.

The key is to track this rate by cohort (month, industry, company size, region, or campaign) and source (Google Ads, LinkedIn, webinars, referrals, content syndication, etc.). This reveals which channels drive intent, and which only create noise.

Formula: Lead → Customer = (Customers ÷ Leads) × 100

Example: Campaign A: 5,000 leads → 100 customers = 2%. Campaign B: 1,000 leads → 50 customers = 5%.

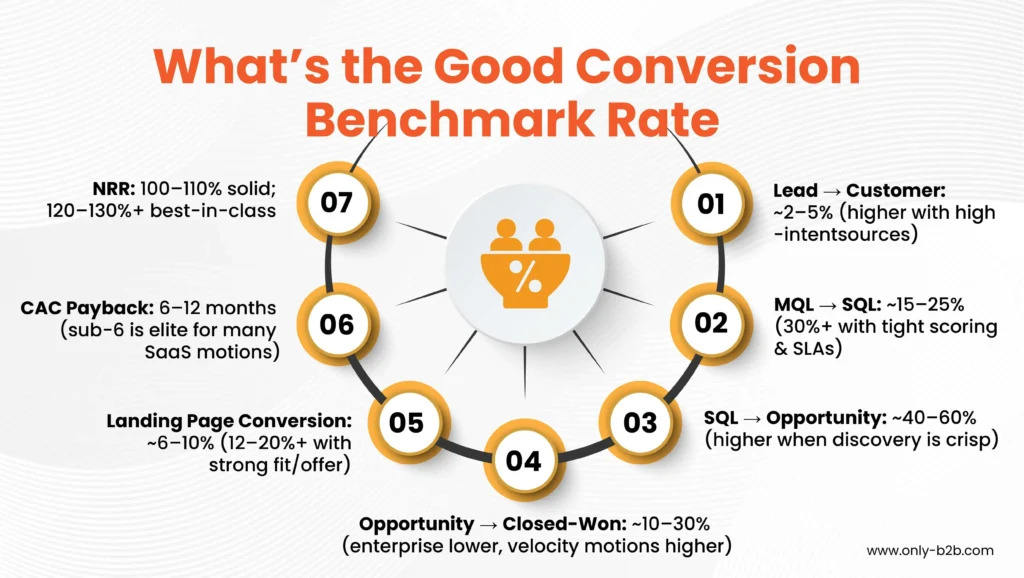

Benchmark: 2–5% overall for many B2B models.

Tools: HubSpot or Salesforce for stage tracking; Tableau/Power BI for source and cohort analysis.

MQL → SQL Conversion Rate

A classic tension: marketing insists leads are good, sales disagrees. When the conversion rate is low, it usually means either sales failed to follow up quickly or marketing delivered weak leads.

When the rate is high, it shows you’ve nailed lead scoring, timing, and ICP fit.

Formula: MQL → SQL = (SQLs ÷ MQLs) × 100

Example: 400 MQLs → 80 SQLs = 20% (healthy). At 10%, either scoring, ICP, or follow-up is broken.

Tools: Marketo, Pardot, or HubSpot for lead scoring; Salesforce for acceptance tracking.

SQL → Opportunity Conversion Rate

A strong rate here is the cue that discovery and problems are real enough to take the next step.

If it is weak, either “SQL” is being declared too early, or conversations are not landing on urgency and consensus.

Many think this dip is a pricing issue, but the actual reason behind this is misalignment on pain, priority, or power.

Formula: SQL → Opp = (Opportunities ÷ SQLs) × 100

Example: 100 SQLs → 45 opportunities = 45% (within health range).

Benchmark: Mature orgs often sit at 40–60%.

Tools: Salesforce or Pipedrive for stage definitions; Clari to highlight where deals stall.

Opportunity → Closed-Won Rate

When win rates dip, leadership often blames sales skills. But underneath is usually poor ICP targeting and single-threaded deals. To improve on this metric, you must track win rate by segment, competitor, and use case to learn where you truly win.

Formula: (Closed-Won Deals ÷ Opportunities) × 100

Example: 80 opportunities generate only 16 closed deals. That is a 20% win rate. A weak win rate means poor ICP targeting and single-threaded deals.

Benchmark: Many mid-market/velocity motions hit 10–30% (enterprise often lower).

Tools: Salesforce/HubSpot Sales Hub for win-loss; Clari for forecast accuracy and risk signals.

Cost & ROI Metrics

Cost per Lead (CPL)

CPL should be as low as possible. Is it not? But chasing the lowest number is a bad trap.

Obviously, because cheap leads that do not add to the pipeline are the most expensive waste you can buy.

Example:

- Channel A: $5,000 spend → 500 leads ($10 CPL) → 25 SQLs = $200 per SQL

- Channel B: $5,000 spend → 100 leads ($50 CPL) → 40 SQLs = $125 per SQL

On paper, Channel A looks cheaper, but Channel B delivers better results. That is also why CPL is what matters in budget debates. To do it effectively, pair CPL with downstream conversion.

Tools: GA4 and UTM hygiene for channel costs; HubSpot/Marketo to connect lead source to pipeline.

Customer Acquisition Cost (CAC) & Payback

CAC blends marketing and sales spend, which is why it ends up in excuses. If CAC stretches too thin against your payback target, you either cut waste, raise ACV, accelerate cycles, or sometimes all three.

Example: $120,000 spend ÷ 60 customers = $2,000 CAC. With $500/month margin, payback = 4 months (healthy). A payback of 18–24 months signals risk.

Benchmark: Many SaaS teams target 6–12 months payback.

Tools: CRM + BI for CAC/payback modeling; attribution features in HubSpot/Marketo to tie costs to revenue.

Lifetime Value (LTV) and the LTV: CAC Ratio

LTV shows you how much you can justifiably spend to win a customer. When the LTV:CAC ratio is too low, it signals that you should spend less.

Healthy ratio = 3:1 or higher.

To lift the ratio, you must fix onboarding, adoption, and expansion motions. Because that is what lifts LTV without touching CAC.

Formula (SaaS-style): LTV ≈ (ARPA × Gross Margin %) ÷ Churn Rate

Example: $10,000 ARPA × 70% margin ÷ 10% churn = $70,000 LTV. With $20,000 CAC → 3.5:1 (healthy).

Tools: CRM + billing systems; CS platforms for adoption insights.

Content & Campaign Conversion Metrics

Landing Page Conversion Rate

Great pages are simple and clarify value in a single screen. Weak ones ask visitors to do the homework. Does it not?

If your conversion rate feels soft, resist celebrating the temptation of vanity signals like “time on page” or “scroll depth.” Those are activity metrics, not buying signals.

Benchmarks: 6–10% average; 12–20% elite.

Example: 1,000 visitors → 80 form fills = 8% CVR (healthy).

Tools: Unbounce/Instapage for rapid tests; GA4 + HubSpot for funnel tracking.

Gated Content → Lead → Pipeline

Downloads mean interest, not intent. The chain that matters is download → qualified conversation → opportunity. If that chain breaks, fix targeting, content specificity, and speed to follow-up before you make another PDF.

Formula: Qualified Lead % = (Qualified Leads ÷ Downloads) × 100

Example: 1,000 downloads → 250 ICP-fit = 25% → 50 opps = 5% pipeline creation.

Benchmark: 25–30% qualified; 10%+ moving toward pipeline is strong.

Tools: Marketing automation for progressive profiling and nurture; CRM for down-funnel attribution.

Webinar/Demo → SQL

Live formats concentrate intent, which is why these often convert above average, if your audience is curated and your next step is explicit. “Great session!” Without a path to value is just a pat on the back.

Formula: Webinar → SQL = (SQLs ÷ Attendees) × 100

Example: 150 attendees → 50 SQLs = 33%.

Benchmark: 20–40% for curated audiences.

Tools: ON24/GoToWebinar for attendee analytics; CRM to map attendee → SQL.

ABM Conversion Metrics

Account Engagement Score

In account-based motions, the buying group, not the lead, is the unit of progress. A rising engagement score across multiple roles beats one hyperactive champion every time. A low score with high activity from one person usually signals a future stall.

Example: Account A has one champion doing 20 actions; Account B has four roles, each doing five actions. Account B is healthier (breadth > depth).

Tools: Demandbase/6sense/Terminus for account-level scoring synced to CRM.

Pipeline Influence & Stage Progress

Measure how targeted touches accelerate stage movement and increase deal creation in named accounts. If influence is high but opportunities do not appear, your content is educating without mobilizing.

Formula: Influence % = (Pipeline $ touched by ABM ÷ Total Pipeline $) × 100

Example: $4M total pipeline; $2M touched by ABM = 50% influence.

Tools: ABM platforms + CRM attribution models.

Buying Committee Coverage

Track how many essential roles have interacted meaningfully. Single-threaded deals feel fast until procurement, security, or finance enters. Coverage transforms “surprises” into planned steps.

Formula: Coverage % = (Engaged Roles ÷ Required Roles) × 100

Example: Need 6 roles; engaging 2 → 33% coverage (risky).

Benchmark: Push for 50%+ coverage early.

Tools: Salesforce for role mapping; intent tools for persona-level signals.

Retention & Expansion Conversion Metrics

Renewal Rate

Renewals reflect whether value is realized, not just promised. Lagging renewals often stem from onboarding debt or quiet under-adoption long before renewal month. The fastest fix is earlier health monitoring, not last-minute discounts.

Formula: Renewal % = (Renewals ÷ Contracts Up) × 100

Example: 100 up for renewal → 90 renewed = 90%.

Benchmark: Many SaaS motions see 85–95% logo retention.

Tools: Gainsight/Totango for health scoring and success playbooks.

Upsell & Cross-Sell Conversion

Expansion is easiest when usage naturally hits the ceiling of a current tier. If reps must “convince,” packaging and in-product prompts likely need work. Tie expansion offers to observed outcomes, not generic lists of features.

Formula: Expansion % = (Customers Expanded ÷ Customers Approached) × 100

Example: 200 approached → 50 expand = 25%.

Benchmark: 20–30%+ is strong in SaaS.

Tools: CS platforms + product analytics; HubSpot Service Hub for offers and workflows.

Net Revenue Retention (NRR)

NRR tells you whether existing customers power growth even when new logo velocity dips. When NRR is stuck near 100%, look for silent contraction, such as seats, usage, or modules quietly dropping.

Formula: NRR = (Start Rev + Expansion – Churn) ÷ Start Rev × 100

Example: Start $1M; churn $200K; expand $300K → 110% NRR.

Benchmark: 100–110% good; 120–130% elite.

Tools: CS + billing + CRM stitched in BI to surface contraction early.

Advanced & Future-Focused Metrics

Deal Velocity

Speed reveals friction. If deals linger in the same stage, you are missing assets, proof, or stakeholders. Reducing cycle time often beats adding more top-funnel spend.

Formula (one way): Velocity ≈ (Opportunities × Win Rate × Avg Deal Size) ÷ Sales Cycle

Example (cash flow reality): $200k product, 6-month cycle; need 5 clients for $1M. You will likely need about 9 months of runway before revenue lands.

Tools: Clari/Salesforce Revenue Intelligence to flag stage aging and next-best actions.

Predictive Conversion

Machine-learned propensity scores are only as good as your definitions and data hygiene. Treat them like headlights: they show where to look, but you still have to drive. Use them to prioritize outreach and budget, then verify with real-world conversion.

Example: Deal A (multi-threaded, high intent) scored 75% win likelihood; Deal B (single-threaded, stalled) scored 20%. Focus team time on A.

Tools: Clari/Gong for win-probability and risk indicators.

Multi-Touch Attribution

Attribution does not need to be perfect to be useful. The goal is to fund the motions that consistently show up before real opportunities, not to crown a single hero channel. Start simple (position-based), and evolve as data quality improves.

Example (position-based): First touch (LinkedIn ad) 40% credit, middle touches 20%, last touch (demo) 40%. The program mix, not one channel, earned the win.

Tools: Marketo Measure (Bizible), HubSpot attribution, or BI-built models.

Conclusion

Pick metrics that force clarity: MQL → SQL, SQL → Opportunity, Opportunity → Won, CAC & payback, and NRR. Use CPL, landing page conversion, and webinar/demo conversion to refine programs. Not to declare victory.

As you mature, add deal velocity, buying-group coverage, and simple attribution to fund what actually moves deals. Tools amplify discipline; they don’t replace it. Define success, clean the data, and let these metrics turn debates into decisions and decisions into durable revenue.

Vikas Bhatt is the Co-Founder of ONLY B2B, a premium B2B lead generation company that specializes in helping businesses achieve their growth objectives through targeted marketing & sales campaigns. With 10+ years of experience in the industry, Vikas has a deep understanding of the challenges faced by businesses today and has developed a unique approach to lead generation that has helped clients across a range of industries around the globe. As a thought leader in the B2B marketing community, ONLY B2B specializes in demand generation, content syndication, database services and more.