If you had to choose one channel for B2B growth, would you bet on content syndication’s intent or paid media’s speed and scale?

Modern growth teams are expected to build visibility, pipeline quality, and revenue velocity at the same time.

Content syndication and paid media are both popular choices, yet they are built on very different assumptions about how buyers are influenced.

According to Gartner, B2B buyers spend only 17% of their buying journey engaging directly with vendors, while most decisions take shape during independent research.

That reality makes this choice less about preference and more about timing, context, and where influence truly happens.

Content Syndication Explained

Table of Contents

Content syndication involves distributing existing long-form assets, typically whitepapers, case studies, research reports, and guides across third-party platforms that already attract your target audience.

It is designed to capture and shape demand that already exists.

These platforms might include industry publications, professional communities, analyst networks, or curated resource hubs.

In return, marketers gain exposure, engagement data, and, in paid models, first-party lead information from readers who actively choose to access the content.

What distinguishes syndication is not the asset itself, but the environment in which it appears. The content is framed as education, not promotion.

It is encountered alongside peer insights, market analysis, and independent perspectives, which subtly changes how it is received.

There are two dominant operating models in content syndication.

It prioritizes reach and visibility. Content is republished or referenced without a direct exchange of contact information. The goal is brand presence, authority building, and extended shelf life across third-party platforms.

It is performance-driven. Brands sponsor placement and distribution, and in return receive lead details tied to specific content consumption.

Qualification criteria such as job role, company size, industry, and geography are often applied to filter engagement.

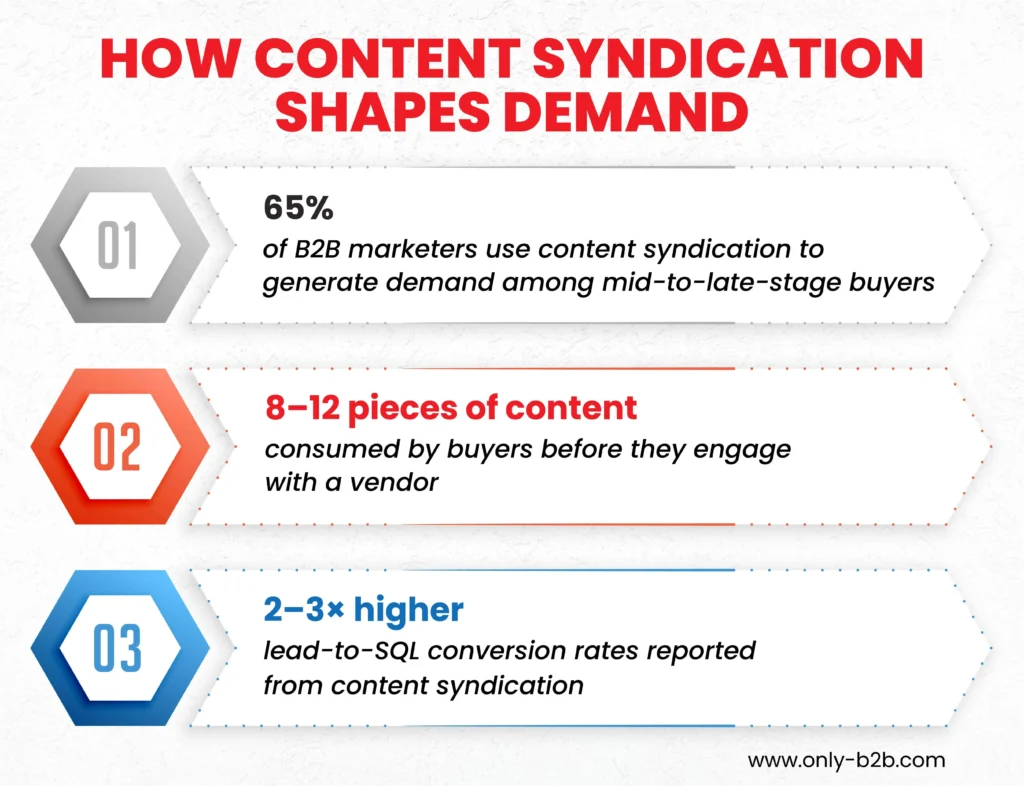

Adoption has accelerated as B2B buying has become more self-directed. Research shows that buyers now consume an average of 8–12 pieces of content before engaging a sales representative.

Content syndication supports this behavior by placing depth-oriented assets where research is already happening.

Why Content Syndication Works

Content syndication succeeds because it supports how buyers prefer to learn, evaluate, and build conviction. Around 67% of marketers consider content syndication as leading method to connect with their target audience.

Relevant reach

Syndicated assets appear inside environments buyers already visit for insight. This reduces resistance and increases engagement with complex ideas, particularly in categories where risk and scrutiny are high.

The buyer is already in an evaluative mindset, which changes how information is processed.

Intent through effort

Depth acts as a filter. Downloading a long-form asset from a third-party platform requires time, attention, and cognitive effort.

That effort signals evaluation behavior rather than casual interest, improving downstream qualification without forcing artificial gating mechanisms.

Credibility accumulation

Repeated presence alongside respected publishers compounds authority over time. Instead of asserting expertise, brands borrow credibility from the environments they appear in.

This is particularly effective for emerging categories or complex offerings that require trust before comparison.

Mid‑funnel influence

Content syndication is structurally aligned to the middle of the buyer journey. It supports problem framing, internal justification, and shortlist creation, stages where buyers need language, data, and validation more than promotion.

Extended value beyond the campaign

Syndicated content often continues to generate referral traffic, backlinks, and discoverability after distribution ends. Unlike ads that disappear when spend stops, syndication assets compound value over time.

Predictable economics

Content syndication costs are influenced by audience quality and platform credibility rather than bidding dynamics. This predictability makes planning easier, particularly for teams managing longer sales cycles and multi‑quarter targets.

Paid Media Explained

The paid media definition is more familiar, but its complexity has increased.

Paid media refers to placing advertisements across platforms such as Google Ads, LinkedIn, and display ad networks in exchange for guaranteed visibility.

Campaigns are structured around targeting parameters, bidding strategies, creative formats, and conversion objectives.

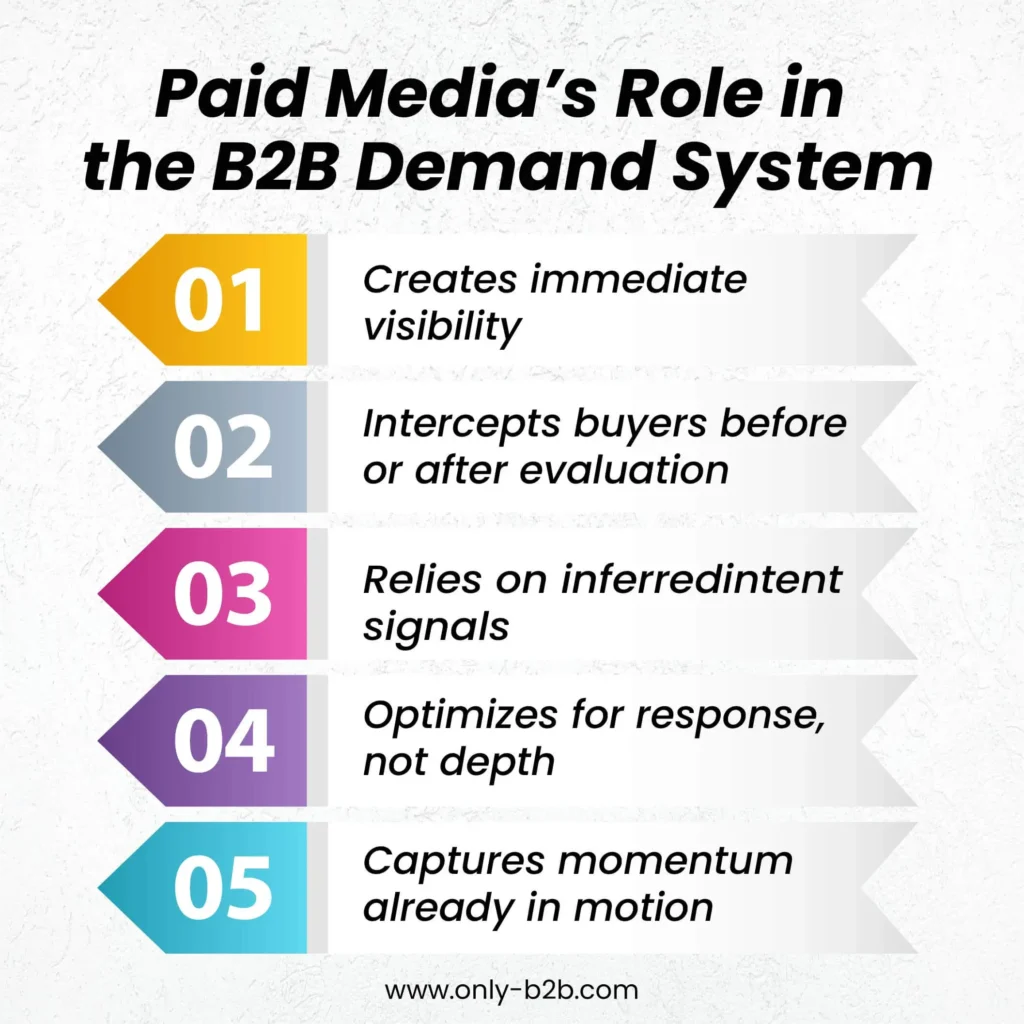

Unlike syndication, paid media introduces a message into moments that were not explicitly created for it. Search advertising is the partial exception, where intent is declared through queries.

Social and display formats rely on relevance modeling, behavioral data, and frequency to generate response.

Operationally, paid media drives traffic to landing pages or native lead-generation forms. Performance is tracked through impressions, clicks, conversion rates, and downstream attribution models.

Within content syndication vs paid media, paid media is typically associated with speed. Campaigns can be launched quickly, adjusted rapidly, and scaled aggressively as long as budgets allow.

Why Paid Media Works

Paid media delivers value through speed, control, and measurable response.

Targeting flexibility

Audience segments can be built and refined using firmographic, behavioral, and engagement signals. This allows teams to test positioning quickly and identify which messages resonate across segments.

Immediate visibility

Campaigns can be activated rapidly, making paid media effective for launches, promotions, and time‑sensitive initiatives. It fills gaps where awareness needs to be created rather than nurtured.

Operational transparency

Performance feedback is near real‑time. Click‑through rates, conversion rates, and cost metrics provide immediate signals that support rapid iteration.

Low‑friction conversion paths

Native lead forms reduce steps between interest and submission, supporting consistent volume even when attention spans are short.

Retargeting leverage

Paid media is particularly effective when layered onto existing engagement. Retargeting known visitors or syndicated audiences improves efficiency and relevance.

These strengths come with structural trade‑offs. Rising competition increases costs. Creative fatigue reduces effectiveness over time. Dependence on platform algorithms introduces volatility that teams do not fully control.

Cost and ROI Considerations

ROI differences between channels reflect how and when they influence buying behavior.

Content syndication tends to deliver steadier performance because pricing is not auction-driven. This stability matters as competition and automation increase volatility across ad platforms.

Paid media provides faster feedback but greater exposure to fluctuation. Minor changes in competition, relevance, or algorithms can materially alter results.

Syndication appears in assisted or multi-touch models, while paid media more frequently receives last-touch credit.

Evaluating either channel in isolation obscures its real contribution. Performance should be assessed as behavioral impact across the journey, not as a single metric.

Content Syndication vs Paid Media

Focus: Quality vs Volume| Aspect | Content Syndication | Paid Media |

|---|---|---|

| Core role | Influence active researchers | Create or capture attention |

| Buyer mindset | Evaluating and comparing | Discovering or reacting |

| Engagement depth | Long-form, high intent | Short-form, low intent |

| Journey stage | Mid to late funnel | Early awareness or bottom funnel |

| Lead quality | Higher sales readiness | Higher volume, mixed readiness |

| Cost behavior | Stable, predictable | Auction-driven, volatile |

| Attribution | Assisted influence | Often last-touch |

Content Syndication vs Paid Media: A Practical Comparison

When teams evaluate content syndication vs paid media, the mistake is assuming both channels influence buyers in the same way. They do not. Their impact differs across timing, intent, cost behavior, and buyer mindset.

1. Buyer intent and context

Content syndication places long-form assets inside third-party environments buyers already trust.

Research shows that B2B buyers typically consume between 8–12 pieces of content before engaging sales, much of it sourced from independent platforms.

Paid media, by contrast, often captures attention earlier or later, introducing a message or reactivating known demand rather than shaping understanding.

2. Speed versus depth

Paid media delivers immediate visibility. Campaigns can launch quickly and scale as long as budget allows.

Content syndication builds more slowly, but it supports deeper engagement. Buyers spend more time with assets, increasing message retention and evaluation confidence.

3. Cost behavior

Content syndication costs tend to be more stable because pricing is not auction-driven. Industry benchmarks frequently cite average CPLs around $40–$50 depending on audience and asset depth.

Paid media costs fluctuate based on competition, bidding pressure, and platform changes, making forecasting more difficult over time.

4. Attribution patterns

Paid media is more likely to receive last-touch credit, particularly in bottom-funnel scenarios. Content syndication often influences earlier stages, appearing in assisted attribution models rather than closing reports.

Seen together, these differences clarify why comparison alone is insufficient. Alignment is what turns both channels into contributors rather than competitors.

When to Use Content Syndication and Paid Media Together

High‑performing demand engines assign each channel a distinct responsibility rather than expecting identical outcomes.

Content syndication supports research, comparison, and internal alignment by delivering depth where buyers are already learning. It helps prospects articulate problems, evaluate approaches, and justify decisions internally.

Paid media accelerates awareness, reinforces recall, and captures intent once interest is established. It is most effective when amplifying narratives that buyers already recognize rather than introducing unfamiliar ideas.

Used together, syndicated engagement informs retargeting strategies, while paid media reinforces themes that have already earned attention. This sequencing reduces waste and improves message relevance.

Effectiveness improves when channels are designed to complement rather than substitute for one another. The goal is not balance for its own sake, but coherence across the buyer journey.

Conclusion & Next Steps

Choosing between channels is hard only when every channel is expected to do the same job. Buying influence today is shaped earlier, quietly, and mostly outside vendor touch points.

To act with clarity:

- Use content syndication to reach buyers while they are actively researching

- Let paid media support speed and recall, not primary education

- Focus on sales readiness, not raw lead volume

Partnering with Only B2B can help you place content where real decisions begin. When influence happens at the right time, growth stops feeling unpredictable.

Vikas Bhatt is the Co-Founder of ONLY B2B, a premium B2B lead generation company that specializes in helping businesses achieve their growth objectives through targeted marketing & sales campaigns. With 10+ years of experience in the industry, Vikas has a deep understanding of the challenges faced by businesses today and has developed a unique approach to lead generation that has helped clients across a range of industries around the globe. As a thought leader in the B2B marketing community, ONLY B2B specializes in demand generation, content syndication, database services and more.