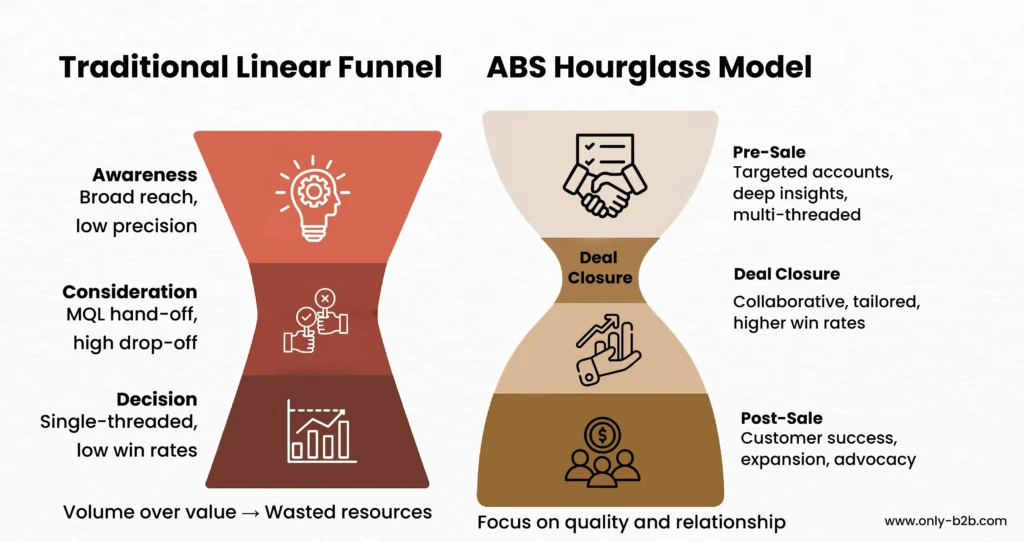

B2B buying cycles today look nothing like they did a decade ago. Traditional sales tactics, once the backbone of the pipeline, are now only good to deliver diminishing returns: wasted sales efforts, low win rates on high‑value accounts, and falling ROI.

The message is clear: spray‑and‑pray lead generation is no longer enough.

The good news? A proven alternative exists.

Account‑Based Sales (ABS) has emerged as the sophisticated playbook for high‑value, predictable growth. And that’s what we are going to share with you today.

In this blog, we’ll discuss the mindset shift from lead‑centric to account‑centric selling, the pillars of ABS, and actionable strategies you can apply immediately.

Let’s dive in!

What Is Account‑Based Sales (ABS)?

Table of Contents

- 1 What Is Account‑Based Sales (ABS)?

- 2 The Lead‑Centric to Account‑Centric Mindset Shift

- 3 The Playbook for Account‑Based Sales Success

- 4 Account‑Based Sales Best Practices for 2026

- 5 Iterative ABS Strategies

- 6 A Word of Caution: Context Matters

- 7 The Path Forward: Building Your ABS Roadmap

- 8 Final Thought

Account‑Based Sales (ABS) is a strategic, account‑centric approach to B2B selling. Instead of broad targeting, ABS flips the funnel by focusing on selectively chosen high‑value target accounts. It goes the extra mile with personalized, multi‑channel engagement to convert them into customers.

It isn’t just another sales tactic. ABS is a cross‑functional system that aligns sales, marketing, and customer success around the same accounts, the same goals, and the same metrics.

ABS is more about quality than quantity. It asks:

Which accounts have the highest potential impact on revenue?

Who within those accounts influences the decision?

How can we deliver insights and value tailored to their unique priorities?

Succeeding with ABS requires deep account intelligence, multi‑threaded engagement, and personalized outreach, all supported by data and AI.

And the result? A tighter, more relevant buying journey that reduces wasted effort while increasing win rates, deal size, and long‑term account value.

The Lead‑Centric to Account‑Centric Mindset Shift

ABS is growing in popularity. Many teams are adopting it, but it is widely misunderstood. Teams often tell us:

“We already target our ICP; isn’t that ABS?”

“ABS is just another marketing buzzword — our sales process works fine.”

This reflects a critical misconception. Broad ICP targeting isn’t enough. ABS digs into the DNA of each account: their business priorities, buying committee structure, internal dynamics, and external pressures.

Why does this detail matter? Because without that, ABS becomes simply “refined outbound,” which doesn’t solve the real problem: the disconnect between how sellers push and how buyers decide.

The shift means creating a selective, defined list of Ideal Target Accounts (ITAs) and committing to deeply understanding and engaging them. This is where predictable growth begins.

The Playbook for Account‑Based Sales Success

1. Identifying Ideal Target Accounts

Too often, sales teams build lists on static firmographics and past deal history. In reality, these lists rarely reflect true buying intent.

Instead, ABS combines firmographics with technographics, intent data, and strategic fit.

According to 6sense, companies using intent data to prioritize accounts report up to 77% revenue growth and 84% pipeline growth.

For instance, a SaaS provider targeting financial services shouldn’t just look at “banks with $1B+ revenue.”

Mini‑Checklist for ITA Criteria

- Evidence of strong intent (vendor comparisons, content engagement)

- Similarity to high‑value existing customers

- Technographic alignment (ERP, CRM, or analytics stack fit)

- Budget capacity tied to current initiatives

- Competitive switching signals

This way, your time and resources focus not on the largest accounts, but on the most winnable and valuable ones.

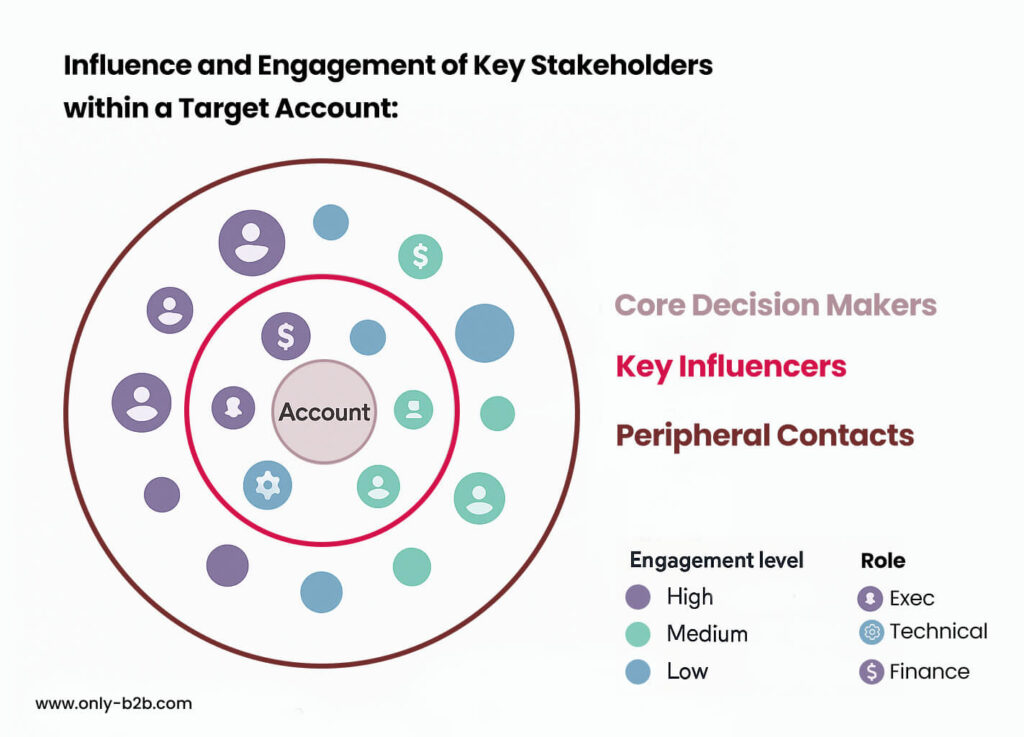

2. Deep Account Intelligence

ABS is not just a marketing program. It is a system that hinges on sales, marketing, and increasingly, product and customer success. Together, they build a shared intelligence layer about each account.

Once ITAs are identified, the focus shifts from “who” to “how well we understand them.”

ABS excellence means:

- Mapping the buying committee: Who holds budget authority? Who influences evaluation? Who can block decisions?

- Identifying stakeholder pain points: Business challenges, departmental goals, and hidden objections.

- Recognizing internal politics: Champions vs. detractors, decision‑making hierarchies, and past vendor experiences.

- Aligning with strategic initiatives: What top business priorities drive their purchase timeline?

This intelligence isn’t static. It is dynamic and must be treated as a shared organizational knowledge base, easily tapped by sales, marketing, product, and customer success.

Account‑Based Sales Best Practices for 2026

Personalization at Scale

Buyers today are obsessed with attention. 71% of B2B buyers now expect tailored experiences, and personalized engagement makes them 80% more likely to purchase (McKinsey reports).

For example, imagine a CFO at a $500M manufacturing firm receiving this message:

“Our platform can help streamline your marketing operations and improve lead generation across digital channels. Let’s connect to discuss how we can support your growth.”

This is irrelevant noise, isn’t it? It’s like someone wishing you “Happy Graduation!” on your wedding day. The intent may be positive, but the context is missing. Instead of feeling valued, you feel unseen.

AI‑driven orchestration tools solve this problem. They deliver custom messages across channels without sacrificing efficiency. For example:

- Tailored LinkedIn outreach referencing recent company news

- Personalized content hubs aligned to industry verticals

- Adaptive email sequences reflecting buyer behavior

Multi‑Threaded Engagement

The single‑threaded approach to ABM — one champion carrying your solution into their committee — is a relic.

ABS is no longer about a single champion. Buying groups dominate enterprise and mid‑market deals. Engaging 5–10 stakeholders across departments isn’t easy, but it builds deal resilience and accelerates consensus.

How to enable this in practice:

- Equip SDRs to warm multiple contacts simultaneously

- Use LinkedIn Navigator and intent data to identify influencers beyond the known champion

- Align messaging to each persona’s specific KPIs

Companies running multi‑threaded ABS campaigns report 60% higher win rates (RollWorks).

In simple terms: marketing primes conversations with thought leadership, sales engages decision‑makers with tailored business cases, and customer success offers proof points from similar deployments.

Together, the team creates resilience: even if one thread snaps, the account doesn’t break off.

Cross‑Functional Orchestration

Silos kill ABS. Here’s what it looks like:

Marketing measures success by MQLs, while sales cares only about closed‑won deals. Customer success may not even be looped in until after the contract is signed. The result: disjointed buyer experiences and slow deal cycles.

Teamwork is dream work in ABS. Every unit works around the same ITAs with strategic, calculated steps to move the account forward.

To succeed, sales, marketing, and customer success must:

- Plan jointly: Share ITA lists and campaign calendars

- Engage collaboratively: Marketing warms accounts while sales advances conversations

- Close the loop: Customer success feeds back retention and expansion signals into targeting models

When aligned, these teams drive a seamless buyer journey instead of fragmented outreach.

AI‑Driven Insights and Prioritization

AI is no longer optional. It is the competitive edge.

Consider LinkedIn’s Account Prioritizer engine, which drove an 8.1% increase in renewal bookings by predicting upsell and renewal likelihood.

Applications include:

- Scoring ITAs based on likelihood to engage

- Predicting churn risk to protect existing revenue

- Identifying cross‑sell opportunities in current accounts

Without AI, teams are overwhelmed by signals — webinar attendance, competitor content downloads, LinkedIn activity, tech stack changes — and miss critical buying shifts.

Machine‑learning models act as the central nervous system of ABS, tirelessly scoring accounts for conversion potential, churn risk, or expansion opportunity.

This helps you avoid chasing in the dark because your efforts are directed precisely where they yield the highest impact.

Iterative ABS Strategies

A one‑size‑fits‑all approach doesn’t work. The most effective organizations now blend:

One‑to‑One: Highly personalized for strategic accounts

One‑to‑Few: Semi‑customized for industry clusters

One‑to‑Many: Scaled campaigns using intent‑driven personalization

A Word of Caution: Context Matters

Before jumping into ABS, leaders must pause and assess their context.

A 10‑person SaaS startup won’t orchestrate ABS the same way a 2,000‑employee enterprise will.

Similarly, selling into SMBs with short buying cycles requires a different playbook than targeting Fortune 500 enterprises.

You must consider:

- Your team’s size and capabilities

- The complexity of your buyers’ decision processes

- The maturity of your CRM and ABM technology stack

- The specific goals you want to achieve in the next 12 months

Without this clarity, ABS risks becoming another shiny initiative that looks good but falls flat in execution.

The Path Forward: Building Your ABS Roadmap

ABS is not a campaign but a system of growth. That system should be grounded in three pillars:

- Precision targeting of ITAs using AI‑driven data

- Deep multi‑threaded engagement across buying committees

- Cross‑functional orchestration to deliver cohesive, personalized experiences

When executed well, ABS shines in the chaos of B2B growth, transforming into a predictable, high‑value pipeline engine.

Final Thought

Buyer expectations are growing sharper every quarter. ABS meets most of them. It is the foundation of predictable, sustainable growth.

And if you’d like guidance in tailoring a roadmap, creating orchestration playbooks, or even building visual assets, Only B2B would be glad to help you take the first step.

Vikas Bhatt is the Co-Founder of ONLY B2B, a premium B2B lead generation company that specializes in helping businesses achieve their growth objectives through targeted marketing & sales campaigns. With 10+ years of experience in the industry, Vikas has a deep understanding of the challenges faced by businesses today and has developed a unique approach to lead generation that has helped clients across a range of industries around the globe. As a thought leader in the B2B marketing community, ONLY B2B specializes in demand generation, content syndication, database services and more.