Optimizes for speed and low commitment — but quality risk sits with your team.

In 2026, the B2B tech buyer is more insulated than ever. According to HubSpot, over 96% of buyers complete their research before ever engaging with a sales team. For SaaS and Tech companies, this means the window to influence a decision is shrinking.

Appointment setting has evolved from a volume-based “numbers game” into a high-precision growth function. It exists to create access during that narrow phase when a buyer is ready to align internally and decide who is worth a conversation.

However, as the role becomes more strategic, appointment setting pricing has become a maze of inconsistent models and hidden costs.

At Only B2B, we believe the real question isn’t “What does it cost?” It’s: “Which pricing model minimizes my risk while maximizing my pipeline velocity?”

This guide breaks down the five dominant pricing structures in the market today so you can choose the one that fits your revenue engine, not just your budget.

Table of Contents

- 1 Decoding the 5 Core B2B Pricing Engines for Appointment Setting

- 2 What You Are Actually Paying For

- 3 Key Factors That Influence Appointment Setting Costs

- 4 Additional Infrastructure and Setup Costs

- 5 Outsourcing vs In-House Cost Comparison

- 6 How to Choose the Right Pricing Model

- 7 ROI Framework for Appointment Setting

- 8 Appointment Setting Pricing Trends in 2026

- 9 Final Thoughts

Decoding the 5 Core B2B Pricing Engines for Appointment Setting

At first glance, appointment setting pricing looks fragmented. Two providers can quote dramatically different numbers for what appears to be the same output: booked meetings.

That gap is rarely accidental.

Pricing models are signals. They show where responsibility sits, who absorbs risk, and how success is measured. In 2026, understanding pricing is less about finding the cheapest option and more about choosing the model that aligns with how your revenue engine actually works.

Most appointment setting engagements fall into five core pricing structures:

- Hourly pricing: This pricing model involves paying for execution time.

- Subscription or retainer pricing: In this model the pay is for dedicated capacity and management.

- Pay-per-appointment pricing: In this model payment is made for only for confirmed meetings.

- Pay-per-qualified-lead (PQL) pricing: In this model payment is done for leads that meet defined criteria.

- Hybrid pricing models: This model involves combining fixed fees with performance-based outcomes.

What You Are Actually Paying For

A clear side-by-side view of pricing models, what vendors charge for, and where risk/control sits.

| Pricing Model | What the Vendor is Paid For | What You Get (Risk + Control) |

|---|---|---|

| Hourly | Time spent | You control quality, risk is yours |

| Retainer | Capacity + management | You get consistency, but pay regardless of outcome |

| Pay-per-appointment | Confirmed meeting | Vendor bears risk, quality depends on criteria |

| Pay-per-qualified-lead | Qualified lead | Quality depends on strict definitions |

| Hybrid Best balance | Base + performance | Balanced risk + predictable cost |

Each model answers a different business question:

- Do you need speed or stability?

- Do you want output or learning?

- Should risk sit with your team or your vendor?

There is no universally “best” pricing model. There is only a best-fit model for your stage, market, and internal readiness.

1. Hourly Pricing Model

Hourly pricing is often the entry point for companies exploring outsourced appointment setting.

How hourly pricing works

- You are billed for the number of hours worked by appointment setters.

- Average hourly rates range around $16–$25 per hour, depending on:

- Region and labor market

- Language proficiency

- Industry familiarity

- Seniority of the appointment setter

Where hourly pricing fits best

Hourly models tend to work when:

- You are testing outbound for the first time.

- Campaign scope is narrow and clearly defined.

- Lists, messaging, and ICPs are already validated.

- Internal teams can actively manage performance.

Why companies choose hourly pricing model

- Straightforward and transparent billing.

- Easy to start with minimal commitment.

- Flexible scaling up or down.

Trade-offs to consider

- Payment is tied to time, not outcomes.

- Quality depends heavily on internal oversight.

- Activity can increase without improving conversion.

Over time, hourly pricing often shifts hidden costs internally:

- Leadership time spent reviewing conversations.

- Sales frustration with inconsistent meeting quality.

- Lost opportunity cost from low-intent conversations.

Hourly pricing assumes execution is the constraint. In reality, strategy and judgment usually are. If hourly-based outreach is leading to low quality conversations, use this guide to tighten structure and improve conversion: How to Build Winning Appointment Setting Strategies for B2B SaaS.

2. Subscription / Retainer Pricing Model

Retainer pricing treats appointment setting as an ongoing revenue function, paying monthly fee.

Typical retainer structure

- Monthly fees typically range from $2,000 to $10,000+

- Pricing varies based on:

- Number of dedicated appointment setters.

- Market complexity.

- Outreach volume.

- Reporting and optimization scope.

What retainers usually include

- Dedicated or semi-dedicated resources

- Campaign setup and ICP refinement

- List building and data enrichment

- Multi-channel outreach execution

- Quality assurance and call monitoring

- Performance reporting and iteration

Why companies choose retainer model

- Predictable monthly investment.

- Consistent team familiarity with your market.

- Performance improves as learning compounds.

Trade-offs to consider

- Requires commitment over multiple months.

- Results are cumulative, not instant.

- Less suitable for short experiments.

For companies with defined sales motions, retainer pricing often delivers the highest long-term ROI because optimization compounds instead of resetting each month.

Retainers perform best when you’re running a repeatable funnel. Here’s how to build the motion: How to Create an Optimized Appointment Setting Funnel That Converts.

3. Pay-per-Appointment Pricing

Pay-per-appointment pricing shifts focus from effort to output. The payment you make is directly related to the number of appointments are set.

How it works

- You pay only when a meeting is booked and confirmed.

- Pricing typically ranges from $50 to $1000+ per appointment.

Factors that affect appointment cost

- Industry difficulty and competition.

- Seniority of the decision-maker.

- Geographic targeting.

- Qualification depth.

Why companies choose pay-per-appointment model

- Direct link between spend and calendar outcomes.

- Lower upfront financial risk.

- Simple budgeting for sales teams.

Trade-offs to consider

- Incentives favor booking over buying intent.

- Higher chance of no-shows if safeguards are weak.

- Qualification disputes are common without clear definitions.

Without strict qualification rules and replacement policies, this model can flood calendars without actually improving pipeline quality.

If your biggest risk is booked meetings that don’t show, this playbook will help you fix attendance without chasing prospects: How to Reduce No-Show Rates in B2B Appointment Setting (Without Chasing Prospects Like It’s Your Job).

4. Pay-per-Qualified Lead (PQL) Pricing

PQL pricing moves accountability earlier in the funnel.

How PQL pricing works

- Payment triggers only when leads meet agreed criteria.

- Typical costs range from $50 to $250 per qualified lead.

Common qualification criteria

- Job title and seniority

- Company size and industry

- Budget or buying intent indicators

- Technology stack or pain alignment

Why companies choose PQL pricing model

- Improves alignment between marketing and sales.

- Reduces wasted follow-ups.

- Focuses effort on relevance, not volume.

Trade-offs to consider

- Qualification standards vary widely.

- Misalignment creates friction.

- Leads may still require nurturing before meetings.

PQL models work only when qualification and follow-up are disciplined. Use these discovery prompts to prevent mismatched “qualified” leads: Open-Ended Questions for Sales You Should Be Asking to Close More Deals.

PQL pricing works best when sales teams are disciplined about follow-up and qualification definitions are documented upfront.

5. Hybrid Pricing Models

Hybrid models are becoming the dominant structure in 2026. it includes paying basic monthly fee plus a variable payment as per performance. It balances accountability and reliability while being flexible.

Typical hybrid structure

- A base retainer covering:

- Strategy

- Team management

- QA and reporting

- Variable fees tied to:

- Appointments booked

- Qualified leads delivered

Why hybrid models are rising

- Balance predictability with accountability.

- Reduce pressure to overbook meetings.

- Encourage long-term optimization.

Hybrid pricing aligns incentives across both sides, making it a strong fit for mid-market and enterprise teams.

Pricing Models Recap: Where Risk & Control Actually Sit

By now, the pattern is clear: pricing isn’t just a number — it’s a decision about who absorbs risk and who controls quality.

Builds consistency and market familiarity — but you pay regardless of short-term outcomes.

Links spend to booked meetings — but can over-optimize for booking vs buying intent.

Improves targeting and follow-up efficiency — but only if definitions are airtight.

Combines predictable capacity with performance incentives — the most stable fit for serious pipeline growth.

Rule of thumb: The best pricing model is the one that reduces wasted conversations and protects pipeline quality — not the one that looks cheapest on paper.

Key Factors That Influence Appointment Setting Costs

Pricing varies because appointment setting difficulty varies.

Primary cost drivers

- Industry complexity: Technical or regulated markets require deeper discovery.

- Decision-maker seniority: VP and C-suite outreach demands personalization.

- ICP precision: Niche targeting increases research time.

- Qualification strictness: Tighter filters increase workload.

- Outreach volume: Higher scale requires stronger infrastructure.

- Channel mix: Email-only vs multi-channel execution.

- Technology stack: Enrichment, deliverability, and intent tools.

- Geographic focus: Competitive regions command higher rates.

- Provider experience: Mature teams price for judgment, not labor.

These variables explain why two programs with identical pricing models can also deliver vastly different results.

Additional Infrastructure and Setup Costs

Headline pricing rarely reflects total investment. Here are some of additional costs you should look for before deciding on the pricing model:

Common additional costs

- One-time on-boarding or setup fees

- CRM integration and customization

- Premium data or intent tools

- Replacement guarantees for no-shows

- Contract minimums or ramp periods

These costs are operational realities, not red flags, as long as they are transparent.

Outsourcing vs In-House Cost Comparison

Many teams compare outsourced pricing against internal hires.

In-house appointment setting costs

- Salaries and benefits

- Hiring and on-boarding time

- Management and coaching

- Tooling and data expenses

- Turnover and ramp losses

Outsourced appointment setting costs

- Faster launch timelines

- Predictable monthly spend

- Access to trained specialists

- Reduced management overhead

In most cases, outsourcing reduces risk during growth or market entry phases, while in-house teams excel once they are experienced.

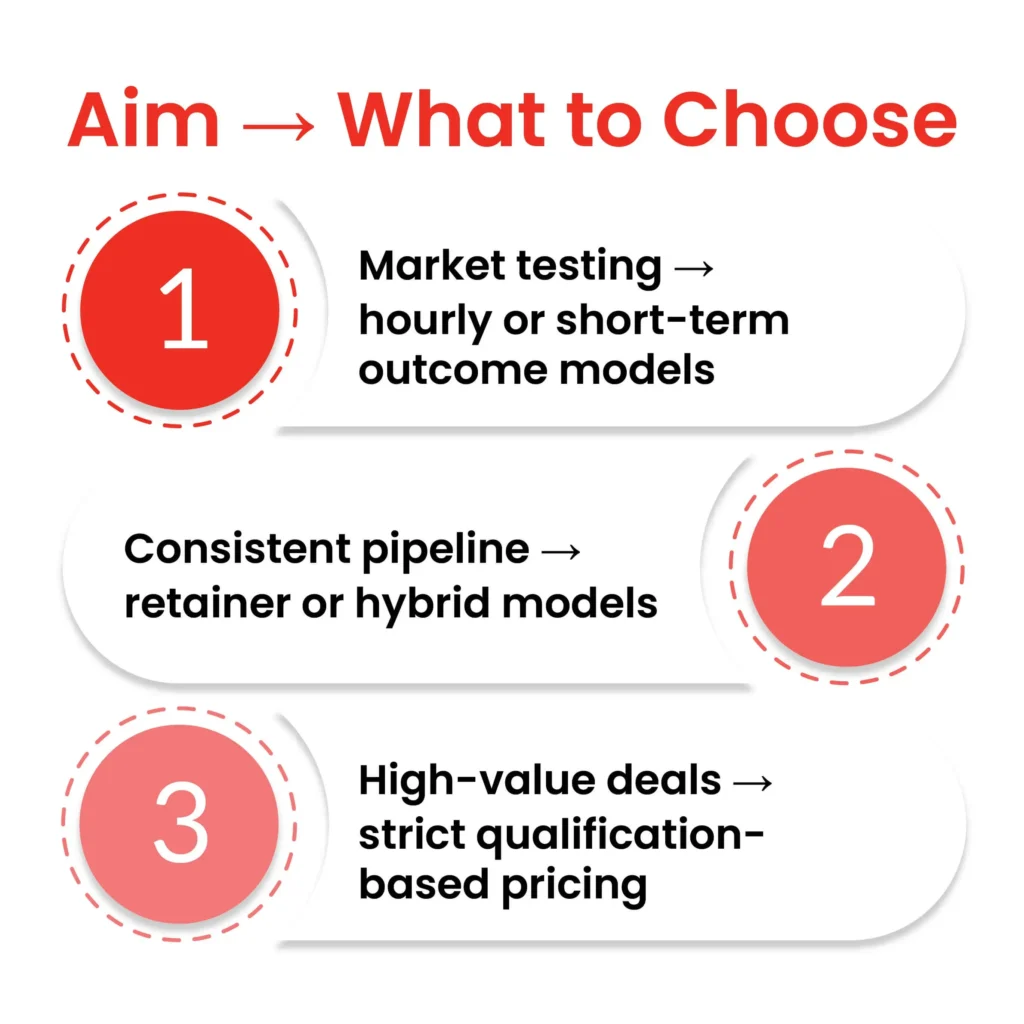

How to Choose the Right Pricing Model

Start with intent, not budget.

Questions to ask providers

- How is quality measured?

- What happens if meetings no-show?

- How is learning retained over time?

- Where does accountability sit?

ROI Framework for Appointment Setting

ROI should be evaluated across the full funnel. Here is an example on how you can do it, to ensure that pricing model is beneficial for your business.

Example framework

- Monthly investment: $5,000

- Qualified meetings: 20

- Opportunities created: 8

- Deals closed: 4

- Average deal size: $15,000

Revenue generated: $60,000

Effective ROI (after sales and operational costs): ~11:1

The goal is not maximizing meetings, it is maximizing revenue efficiency.

Appointment Setting Pricing Trends in 2026

There are several trends that are reshaping pricing structures:

- AI-assisted personalization raising expectations.

- Larger buying committees increasing access difficulty.

- Data privacy reducing list quality.

- Greater emphasis on conversation quality over volume.

Pricing models are evolving to reflect strategic contribution, not just activity.

Final Thoughts

Appointment setting is no longer a support function. It is a revenue lever.

The right pricing model does not minimize cost, it minimizes waste, friction, and lost opportunity.

Teams that win in 2026 are not buying meetings. They are investing in access to decisions already in motion.

That is the lens pricing should be viewed through.

Vikas Bhatt is the Co-Founder of ONLY B2B, a premium B2B lead generation company that specializes in helping businesses achieve their growth objectives through targeted marketing & sales campaigns. With 10+ years of experience in the industry, Vikas has a deep understanding of the challenges faced by businesses today and has developed a unique approach to lead generation that has helped clients across a range of industries around the globe. As a thought leader in the B2B marketing community, ONLY B2B specializes in demand generation, content syndication, database services and more.