MQL to SQL is the golden bridge that connects marketing efforts to revenue. But this bridge is fragile and not easy to cross.

It is the difference between scaling your business and burning through resources, from wasted sales time to inflated acquisition costs and missed opportunities.

Many sales teams stumble because they do not fully understand where this bridge begins or ends. Crossing it successfully requires the right tactics, alignment, and collaboration between marketing and sales. Too often, sales teams fail to use the insights available at each stage of the funnel.

Tracking SQL metrics is the most reliable way to assess lead quality, forecast revenue, and identify where your pipeline leaks or thrives. Companies that actively track SQL performance see 28% higher win rates and 33% more accurate revenue forecasts.

By monitoring these key metrics, you can transform pipeline data into predictable growth.

Table of Contents

Defining an SQL

The moment a lead is ready to hand off from marketing to sales, it becomes a Sales Qualified Lead (SQL). But that moment must be clearly defined.

Typically, teams use qualification frameworks such as BANT (Budget, Authority, Need, Timeline) or advanced models like CHAMP or MEDDIC to evaluate readiness.

An SQL generally meets the following criteria:

- Matches your Ideal Customer Profile (ICP)

- Demonstrates clear buying intent, such as requesting a demo, pricing, or setting a decision timeline

This stage is critical. One wrong move can cost you a deal, but applying too many filters can leave too few leads to pursue. The key is finding the right balance between quality and quantity so that every SQL has both fit and intent.

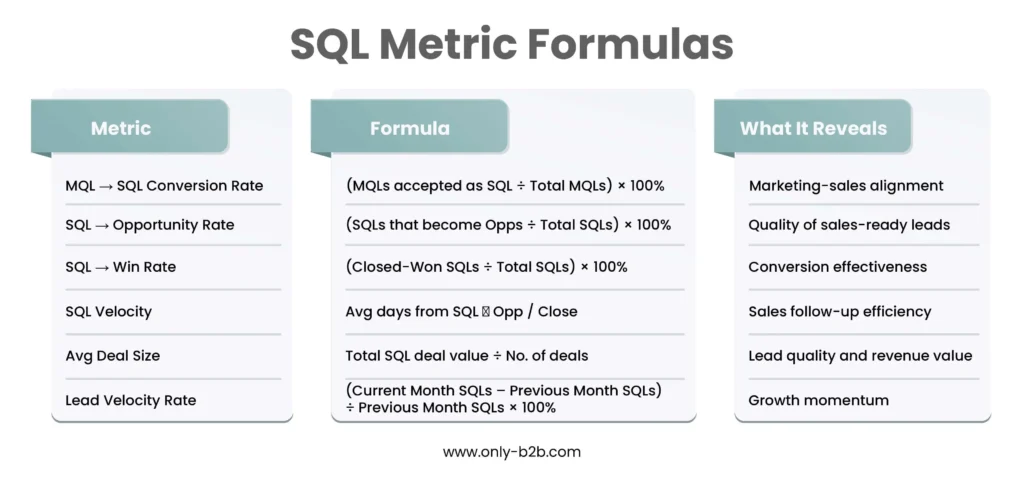

Key SQL Metrics Every Sales Team Should Track

Once you have defined your SQL, the next step is to understand which metrics reveal true performance and efficiency across the pipeline.

1. MQL → SQL Conversion Rate

This metric measures the percentage of Marketing Qualified Leads (MQLs) that become Sales Qualified Leads (SQLs). It directly reflects the alignment between marketing and sales.

A low conversion rate often indicates weak targeting, poor lead scoring, or a lack of communication between teams. However, a high rate is only valuable if the leads are genuinely ready for sales.

Slow-moving leads can create a false sense of pipeline health and waste valuable sales time.

To improve this conversion rate:

- Segment by source or campaign to identify high-quality channels.

- Review rejection reasons to refine qualification criteria.

- Establish SLAs to ensure consistent handoffs between marketing and sales.

Formula: (SQLs ÷ Total MQLs) × 100%

Example: If 500 MQLs are generated and 120 become SQLs, your conversion rate is 24%. Healthy B2B benchmarks range between 20% and 30%.

2. SQL → Opportunity Conversion Rate

Once leads become SQLs, the next question is how many progress into genuine sales opportunities.

This metric shows how effective your sales team is at nurturing SQLs and whether your qualification process is accurate. A low rate may indicate slow follow-ups, poor qualification, or missing context during handoff.

If leads stall at this stage, they were likely not ready for sales or did not receive timely and relevant outreach.

To improve this, track the average time from SQL to opportunity to uncover bottlenecks. Ensure sales reps have discovery notes and context at handoff so that their first contact is personalized and purposeful.

Formula: (SQLs that become opportunities ÷ Total SQLs) × 100%

Example: 120 SQLs → 30 opportunities → (30 ÷ 120) × 100% = 25%.

Use CRM dashboards such as Salesforce or HubSpot to monitor performance by representative, region, or campaign.

3. SQL → Closed-Won Conversion Rate (SQL-to-Win)

This is the ultimate success metric. It measures the percentage of SQLs that convert into paying customers.

If SQL volume is strong but your win rate is low, your qualification process needs improvement. The goal is not to generate more SQLs but to generate better ones.

Analyze win rates by source, sales representative, or campaign to identify which segments perform best. Use these insights to justify marketing spend and allocate resources strategically.

Formula: (SQLs that became customers ÷ Total SQLs) × 100%

Example: 120 SQLs → 18 closed-won deals → (18 ÷ 120) × 100% = 15%.

Regular feedback between marketing and sales helps both teams refine targeting and qualification for continuous improvement.

4. SQL Velocity: Average Time to Opportunity and Close

Velocity measures how quickly qualified leads move through the sales pipeline.

You can track:

- SQL → Opportunity (Days)

- SQL → Closed-Won (Days)

Faster velocity shows efficient follow-ups and engaged buyers. Slow velocity indicates unclear ownership after handoff or weak engagement strategies.

To improve velocity, set internal benchmarks for how long it should take to turn an SQL into an opportunity and from there to a closed deal. Identify and address outliers to maintain consistency.

Sales Metrics Summary

| Metric | Formula | Example |

|---|---|---|

| Avg Days SQL → Opportunity | Total days from SQL to opportunity ÷ Number of SQLs converted | 40 days |

| Avg Days SQL → Close | Total days from SQL to close ÷ Number of closed SQLs | 90 days |

Velocity impacts both sales efficiency and the accuracy of revenue forecasting.

5. Average Deal Size and Pipeline Value from SQLs

Not all SQLs are equal, and this metric helps identify the ones that truly impact your revenue.

Track the average deal size and pipeline value from SQLs to understand which opportunities contribute most to your bottom line.

Compare results across campaigns and channels to see which sources produce the largest deals and which slow down your pipeline.

Average Deal Size: Total deal value from SQLs ÷ Number of closed deals

Pipeline Value: Total value of opportunities generated from SQL-sourced deals

This data helps prioritize high-quality SQLs that lead to larger, more predictable deals.

6. Lead Velocity Rate (LVR) for SQLs

LVR measures the month-over-month growth in new SQLs. It is an early indicator of future pipeline strength but only valuable when quality keeps pace with volume.

Track LVR alongside SQL-to-Win Rate and Average Deal Size. If LVR increases while these metrics decline, it means volume is growing at the expense of quality.

Use intent data and predictive analytics to identify the segments most likely to convert successfully.

Formula: (Current Month SQLs – Previous Month SQLs) ÷ Previous Month SQLs × 100%

Example: April: 110 SQLs → May: 132 SQLs

LVR = (132 – 110) ÷ 110 × 100% = 20%.

Visualizing SQL Metrics: The Funnel View

A clear funnel visualization helps connect all SQL metrics into a single perspective.

When visualized in a dashboard, these stages highlight which campaigns generate high-value, fast-moving SQLs and which need optimization.

Applying the Framework for B2B Tech and SaaS Firms

For Only B2B’s audience, especially tech and SaaS companies focused on demand generation and pipeline acceleration, success depends on consistent, data-driven sales operations.

Here is how to apply this framework:

- Build an SQL dashboard with MQL → SQL %, SQL → Opportunity %, SQL → Win %, Average Deal Size, Pipeline Value, and LVR.

- Segment metrics by campaign or channel to identify ROI drivers.

- Example: Referral campaigns may deliver 40% win rates and $200K average deals, while paid ads yield 15% win rates and $80K deals.

- Set internal targets based on industry benchmarks:

- MQL → SQL ≥ 25%

- SQL → Opportunity ≥ 30%

- SQL → Win ≥ 15%

- Average SQL → Close ≤ 90 days

- Maintain pipeline coverage equal to at least three times your sales quota.

Focus on SQL quality, velocity, and conversion efficiency instead of volume alone.

Conclusion

To successfully cross the golden bridge from MQL to revenue, sales and marketing must operate with shared goals and metrics.

By intelligently tracking SQL metrics, you can turn a reactive sales process into a data-driven, scalable growth engine.

Tracking these metrics helps uncover the root causes of pipeline breakdowns. Improving SQL quality, velocity, and value bridges the gap between lead generation and revenue realization.

When these six SQL metrics are integrated into dashboards and workflows, your teams can shift from saying “We generated leads” to “We generated high-probability, high-value opportunities.”

Untracked SQLs often slip through the cracks, but disciplined tracking ensures every opportunity contributes to predictable, repeatable revenue growth.

Vikas Bhatt is the Co-Founder of ONLY B2B, a premium B2B lead generation company that specializes in helping businesses achieve their growth objectives through targeted marketing & sales campaigns. With 10+ years of experience in the industry, Vikas has a deep understanding of the challenges faced by businesses today and has developed a unique approach to lead generation that has helped clients across a range of industries around the globe. As a thought leader in the B2B marketing community, ONLY B2B specializes in demand generation, content syndication, database services and more.